How South Carolina Residents Can Benefit From the Inflation Reduction Act

The Inflation Reduction Act was signed into law in 2022 in order to fight inflation while accelerating the United States' shift to clean energy.

Beginning in late 2023, Americans will soon be eligible for tax credits and rebates that will make it more affordable to install energy-efficient household systems like heat pumps, air conditioners, furnaces, and other clean burning electrical appliances. This is good news for South Carolina homeowners looking to save money on energy efficient HVAC upgrades and long-term energy bills.

To further explain, let’s take a look at:

Learn more about South Carolina’s HVAC rebates and tax credits with help from Comfort Systems.

Looking to take advantage of state and federal incentives while upgrading your HVAC system? Call Comfort Systems at (803) 324-7572. Our knowledgeable and experienced professionals will guide you through your best heat pump, AC, and furnace installation options, including upfront and honest prices and convenient financing plans. We’ll also help you navigate the various IRA rebate programs and tax credits available, in order to help you save as much money as possible!

What’s Included in the Inflation Reduction Act

In 2022, President Biden signed the Inflation Reduction Act into law, intending to make the United States a global leader in clean energy. As a result, the legislation includes many tax incentives for consumers to reduce their energy consumption with energy-efficient home improvements. This is especially true for households earning less than $300,000 a year.

Let’s take a closer look at what rebates are available, including how much you can save, and eligibility requirements.

HEEHRA Rebate

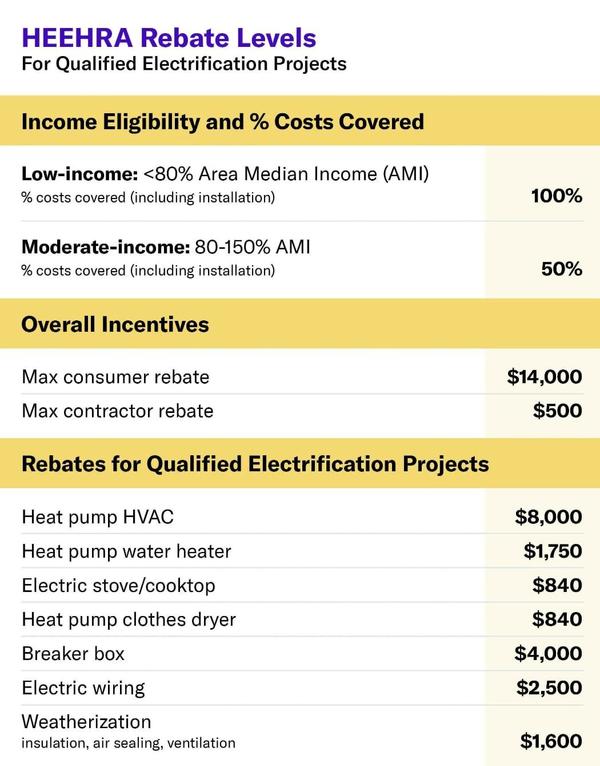

The High-Efficiency Electric Home Rebate Act, commonly known as HEEHRA, offers a 10-year rebate to help low-income and moderate-income homeowners electrify their homes. It primarily applies to electric heat pump installations. So, if you currently heat your home with natural gas or oil, and you install an electric heat pump system instead, you can save on a portion, if not all, of your installation costs.

How Much It Can Save You & Eligibility Requirements

Image Source: Rewiring America

The maximum rebate amount is $14,000. This amount covers electrification projects like heat pump installations, heat pump water heater installations, heat pump clothes dryer installations, and other energy-efficient home upgrades. The maximum rebate for heat pump installations is $8,000.

To qualify, you must make below 150% of the area’s median income. You also must currently have a natural gas, oil, or other non-electric HVAC system in place. If you already have an electric heat pump, for example, you won’t be eligible for a rebate to replace it with another one.

There are various income brackets that provide different rebates and savings. Rewiring America has an online calculator you can use to check out exactly how much money you can save.

You can also give Comfort Systems a call at (803) 324-7572 and we’d be happy to help walk you through your HEERHA rebate options and potential savings.

HOMES Rebate

Also included in the Inflation Reduction Act is the HOMES rebate, standing for “Homeowner Managing Energy Savings.” Similar to HEERHA, this rebate primarily applies to heat pump installations.

How Much It Can Save You & Eligibility Requirements

The standard HOMES rebate is $2,000, and there is no income requirement. Rather, contractors need to prove that your heat pump installation will reap a minimum of 20% energy savings.

South Carolina homeowners may also be eligible for larger rebates if their home improvement project cuts their energy consumption by 35% or more. In this case, your household may be eligible to receive rebates up to $8,000.

Note: You can combine HEEHRA and HOMES rebates if you’re eligible for both, but you can’t apply them to the same project.

The Energy-Efficient Home Improvement Tax Credit

South Carolina homeowners may also qualify for the Energy-Efficient Home Improvement Tax Credit, which covers qualifying air conditioners, furnaces, exterior windows and doors, insulation, smart thermostats, and other improvements designed to increase energy efficiency. The EEHITC used to be called the Nonbusiness Energy Property Credit, but the Inflation Reduction Act changed its name and increased the amount of money available to taxpayers.

Previously, you could only get a $500 lifetime credit for covered improvements. Thanks to the Inflation Reduction Act, the credit is now worth $1,200 per year. You may even qualify for a second credit of $2,000 per year for a biomass boiler, biomass stove, heat pump water heater, natural gas heat pump, or electric heat pump. When you file your tax return, you can claim 30% of what you paid for qualifying home improvements or the maximum credit of $1,200, whichever amount is lower.

Other Ways to Save

The South Carolina government offers tax incentives, low-interest loans, and grants to help residents increase the energy efficiency of their homes. Contact the South Carolina Energy Office for more information about these savings opportunities.

You can also inquire with local utility companies like York Electric and Duke Energy as they often have HVAC rebates tailored to energy-efficiency.

Want to lower your utility bills with a high-efficiency heat pump installation?

Since 1955, Comfort Systems has been York County’s top choice for honest advice, upfront pricing, and 5-star quality HVAC installations, repairs, and maintenance. To get a fixed-price quote on a new heat pump, AC, or furnace installation, call (803) 324-7572 or book a free in-home estimate directly through our website. We’ll review your home’s size, layout, and energy requirements and then provide multiple system options best suited to your needs and budget.